Looks Like The EU is Finally Getting Crypto-Regulation Right

Over the better part of the past decade blockchain and digital assets have emerged from obscurity and concentrated increased interest not only from technologists but also professional and retail investors, entrepreneurs, regulators and the general public. At the heart of their success lie some of the best performing financial assets of the past decade, a multitude of potentially disruptive use cases utilizing blockchain, and arguably, the systematic failings of states and super-states to address fundamental flaws that adversely impact the global economy.

The full EUBOF report on the state of Blockchain in the EU can be read here

Propelled by the ICO boom and the increasing number of applications from the private sector, digital assets and blockchain saw increased interest from regulators in mid 2017. Most countries acknowledged the appeal of digital assets and issued relevant investors warnings. The first state-sponsored studies exploring digital currencies surfaced, accompanied by attempts to regulate the then-popular ICOs. On-chain pilots emerged too, such as the Estonia’s digital currency and Austria’s Culture token, that were swiftly shut down by European regulators. In late 2018, studies from top advisor firms such as Deloitte and PWC largely foreshadowed the increased involvement of institutional players, and China’s primacy in the field, all while initiatives from the private sector highlighted financial services as the “killer application”.

Over the past 2 years, pilot deployments and dormant legislation gave their place to large scale initiatives. States and super-states are competing on the issuance of DLT versions of their sovereign currencies, issuing umbrella regulation to accommodate their paramount implications for modern economies and financial services. Systematic efforts have been put in place to understand and taxonomize digital assets, and sovereign national strategies in advanced nations are becoming increasingly common. In late 2020 the world stands before a tectonic shift, fueled by the acceleration of digital trends due to the COVID19 pandemic, and the climaxing efforts of states to keep up with developments.

In Europe, the European commission has lately issued the markets in crypto-assets regulation (MiCA), a directive that sets the stage for the regulation of digital assets, and a comprehensive report on a digital Europe,outlining a novel, DLT-enabled Euro. Those are expected to shape continent-wide regulation and treatment of digital assets over the next years. Today, however, the digital asset regulatory landscape remains polymorphous and ambiguous as ever. Some countries have embraced transformative technologies with top-down initiatives, while others have remained to simple investor protection warnings.

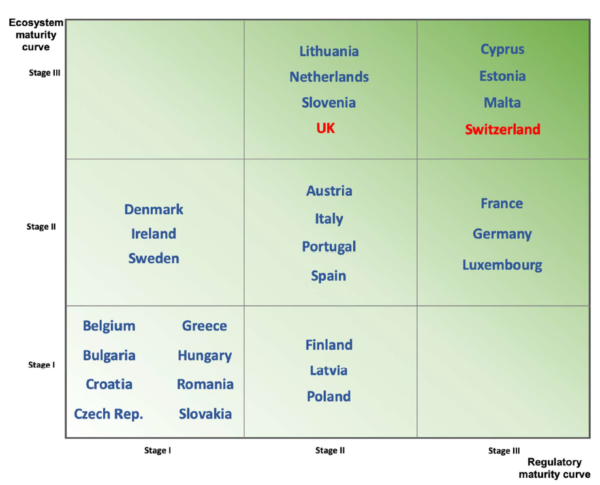

The European Blockchain Observatory and Forum report on the state of blockchain in the EU introduces a framework for ranking countries on a three-stage regulatory maturity curve, based on their specific characteristics. Stage I describes countries where blockchain and digital assets regulation is generally absent, save perhaps for the occasional investor warnings issued by relevant authorities. Countries falling under Stage II have shown significant sings of involvement in the digital assets field. Those have generally adopted wider regulatory schemes that relate to KYC/AML and investor protection or pertain to specific blockchain enabled activities such as ICOs. State-sponsored studies and pilots are also commonplace for countries in Stage II, as is an established framework for the characteristics and the taxation of digital assets. Lastly, countries under Stage III have adopted specific legislation that pertains to digital assets and have voted, published, or are actively developing a national strategy to exploit them. The UK, France, Cyprus, Malta, Estonia, and Switzerland have set a pan-European example with their embracive and innovation-driven approaches, fall under either stage II or III on the framework and have generally adopted more nuanced approaches indicative of industry trends that are worth outlining.

United Kingdom

In 2018 the UK established a dedicated entity responsible for the country’s blockchain and digital asset policy and regulatory approach. The Cryptoassets Taskforce consists of Her Majesty’s Treasury (HM Treasury), the Financial Conduct Authority and the Bank of England (BoE). The authority has defined digital assets and created a framework for their taxonomy based on their characteristics segmenting them into 1)exchange tokens, meaning digital assets that are mainly utilized as a medium of exchange, 2) utility tokens, or assets that can be redeemed for some sort of utility that arises from an underlying blockchain or DLT deployment, 3) Security Tokens, that present similar characteristics to regular securities, such as factual ownership of an underlying financial asset, and lastly, 4) e-money tokens, which fall under the country’s electronic money regulations.However, the establishment of Cryptoassets taskforce in 2018 is not when it all started. In fact, the UK was one of the first countries to realize the potential of blockchain and digital assets in Europe, as evident by a relevant 2015 report by HM Treasury studying the potential benefits, risks and barriers towards their adoption. The report went as far as suggesting specific regulatory actions. A short year later, the country launched its Digital strategy, which focused on the development of businesses in the digital field and included companies active in the field of digital assets and blockchain. Virtual currency taxation is largely governed under a 2019 policy paper issued by HM Revenue and Customs.

France

France is another country that acknowledged the potential of blockchain and digital assets early. Following a 2013 comprehensive reportissued by the French Central Bank on Bitcoin, the French Financial Market Authority (AMF) and Prudential Supervisory Authority warned investors of the potential pitfalls of digital assets that stemmed from their unregulated nature. A 2016 ordinance provided the first definition of blockchain in French law and allowed for the on-chain registering of cash vouchers. In 2017, the French Financial Market Authority (AMF) launched a unique digital-asset fundraising support and research programme (UNICORN) to support and analyse ICOs. France also adopted a specific ordinance to become the first country to authorise the registration and transfer of unlisted securities using blockchain technology.

2019 was a particularly strong year for France with the creation of the French Digital Asset Association, an entity aiming to facilitate laws and regulation that facilitate digital assets and introduce specific taxation schemes. In the same year, the introduction of the G7 cryptocurrency task force in an attempt to better regulate far-reaching digital asset initiatives by private players, further established the country’s involvement with digital assets.

Cyprus

Starting as early as 2014, the Cyprus Securities and Exchange Commission (CySEC) has issued numerous investor and public warnings on digital assets. With low taxation and openness to innovation, the country emerged as an epicentre of blockchain activity. In 2018, the CySEC announced an innovation hub as part of its plan to foster business activity and an informed regulatory landscape for transformative technologies, including blockchain and digital assets. One year later, in 2019 then Finance Minister, Harris Georgiades announced a draft bill to regulate blockchain and digital assets, as part of the country’s national strategy to exploit blockchain and relevant technologies. The bill came into effect later the same year. In the development of their national blockchain and digital assets strategy, Cyprus opted for co-creation, involving the CySEC, Central Bank of Cyprus, relevant ministries, the Parliament at large, and important stakeholders from the private sector, such as the Cyprus bar association and the Cyprus Chartered Accountants Association.On that front, Deputy Minister for Research, Innovation & Digital Policy, Kyriacos Kokkinos, told EUBOF: “We believe that with the implementation of the National Strategy, Cyprus will transform the economy and adopt to new business models, and therefore increase the level of maturity towards disruptive technologies […] In addition, an upcoming DLT and Cryptocurrencies bill contribute towards improving the maturity levels of this technology for Cyprus, and thus, creating an ‘enabling environment’ for technology and FinTech companies to flourish”.

With a national strategy already in place, Cyprus is now closely monitoring and participating in the pan-European discussion on digital assets and is ready to enact necessary changes to align with European guidelines on their regulation, taxation and general treatment.

Malta

Unlike most other countries, Malta’s approach towards digital assets can be characterized as “Regulation First”. In 2018, while addressing the United Nation, then Prime Minister Joseph Muscat presented the country as a “Blockchain Island” and noted that Malta was the first country worldwide to offer clarity in what was previously a “regulatory vacuum”. In the same year, the country had introduced three bills, outlining its comprehensive regulatory framework and establishing its national strategy. The key actors responsible for the trio of laws collectively referred to as the Innovation Framework were: the Malta Digital Innovation Authority(MDIA), the Malta Financial Services Authority (MFSA) and the Malta Gaming Authority (MGA). More specifically, the laws approved by the Maltese parliament were the Virtual Financial Assets Act (VFAA), with an objective to regulate the field of ICOs, digital assets, virtual currencies and related services, the Innovative Technological Arrangements and Services Act, which aimed to set the framework for the registration of technology service providers in the blockchain space and the certification of smart contracts, and the Malta Digital Innovation Authority Act, which established the MDIA, with a role to certify blockchain deployments and smart contracts.The MFSA has introduced a test to separate digital assets in four distinct categories based on their characteristics. Those categories are electronic money, financial instruments, virtual tokens and virtual financial assets. Taxation applies depending on which category an asset falls under. Licensing requirements for activities involving blockchain and virtual currencies are also determined according to provisions of the VFAA. Four different types of licences exist, and companies interested in acquiring one need to apply to the MFSA. Activities in the virtual currency and blockchain space are subject to anti-money laundering (AML) and counter-terrorism financing (CTF) rules.

In early 2020, the country’s blockchain vision was reimagined and incorporated under the wider umbrella of digital innovations, making Malta one of the first countries to lead the trend of incorporating blockchain and digital assets under a wider transformative technology scope.

Estonia

In a country that has integrated blockchain and blockchain-like deployments for its far-reaching digital infrastructure and went as far as to issue a digital currency, a unified national strategy governing DLT and digital assets is notably absent.“It is the effort of individual ministries and government authorities that consider the use of blockchain on a case-by-case basis, rather than an umbrella approach of “blockchain everything”. A [national] strategy can help, but it has to be very well informed, and that is usually the catch.” Florian Marcus Digital Transformation Advisor at e-Estonia told EUBOF.

Despite the lack of a unified strategy, local regulators were some of the first movers worldwide. Estonian law recognises virtual currencies as “value represented in digital form that is digitally transferable, preservable, or tradable, and that natural persons or legal persons accept as a payment instrument”. At the same time, to facilitate the 2017/2018 growth of ICOs, The Estonian Financial Supervision and Resolution Authority (EFSA) published guidelines segmenting digital assets into security, payment, charity and utility tokens, and invited ICO issuers to submit their plans for feedback, so they can be informed of any specific regulations that apply to them.

Estonia has also issued more than 2,000 “Crypto-licenses” for digital currency exchanges and wallet providers.

Switzerland

As of late 2020 Switzerland is home to more than 1,000 companies active in the blockchain and digital assets space. This flourishing ecosystem is in part enabled by the country’s positive regulatory outlook and the fact that the significance of digital assets was realised early by country officials. In 2014, the Swiss federal government published a report addressing their potential economic impact, clarifying their legal treatment and highlighting risks associated with their use and exchange. In the same report, the specific characteristics of digital currencies were also outlined.In 2018, the FINMA published guidelines on how market legislation would apply to the various types of virtual currencies and alternative forms of financing such as ICOs. The FINMA categorised virtual currencies based on their function and purpose as payment tokens utility tokens and asset tokens. Such categorizations, as evident by this article, constitute one of the pillars of every advanced digital assets regulatory framework.

In the second half of 2019, the FINMA officially licensed two institutions, the SEBA Bank AG and Sygnum Bank AG, to operate as regulated virtual currency banking entities. In this way, a new category of blockchain entities was established, as many other businesses, such as Bitcoin Suisse, are expected to apply for licensing too.

In terms of taxation, digital assets are generally treated similar to foreign exchange and their rates vary from canton to canton but are usually determined by the Federal Tax Administration at the end of each year. Assets that do not receive an official evaluation taxable at the cost of acquisition.

Wrapping up

As the European Commission is concentrating efforts in standardizing digital asset regulation across Europe, how the above legislative frameworks adopt, and how the rest of Europe follows will continue to constitute one of the primary developments in the field of digital assets for years to come.Originally published at https://lambisdion.medium.com/at-the-brink-of-a-tectonic-shift-eu-countries-that-do-crypto-regulation-right-3e8d4cd6d8da

Article written by by Lambis Dionysopoulos @lambisdion. Researcher, Institute for the Future, University of Nicosia, European Blockchain Observatory and Forum